Table of Contents

Introduction:

Delta Community Credit Union is not just a financial institution; it’s a cornerstone of empowerment, fostering financial prosperity and community well-being. Since its inception in 1940, Delta Community Credit Union has been a trusted partner for individuals and families, offering personalized services, financial education, and unwavering community support. In this comprehensive exploration, we’ll delve into the rich history, member-centric approach, commitment to financial empowerment, and community impact of Delta Community Credit Union.

History and Evolution:

Delta Community Credit Union traces its roots back to 1940 when a small group of Delta Air Lines employees established the credit union to provide financial services to their fellow colleagues. Over the decades, the credit union expanded its membership eligibility criteria, welcoming individuals and families across multiple states into its fold. Today, Delta Community Credit Union stands as one of the largest and most respected credit unions in the United States, serving hundreds of thousands of members with a wide range of financial products and services.

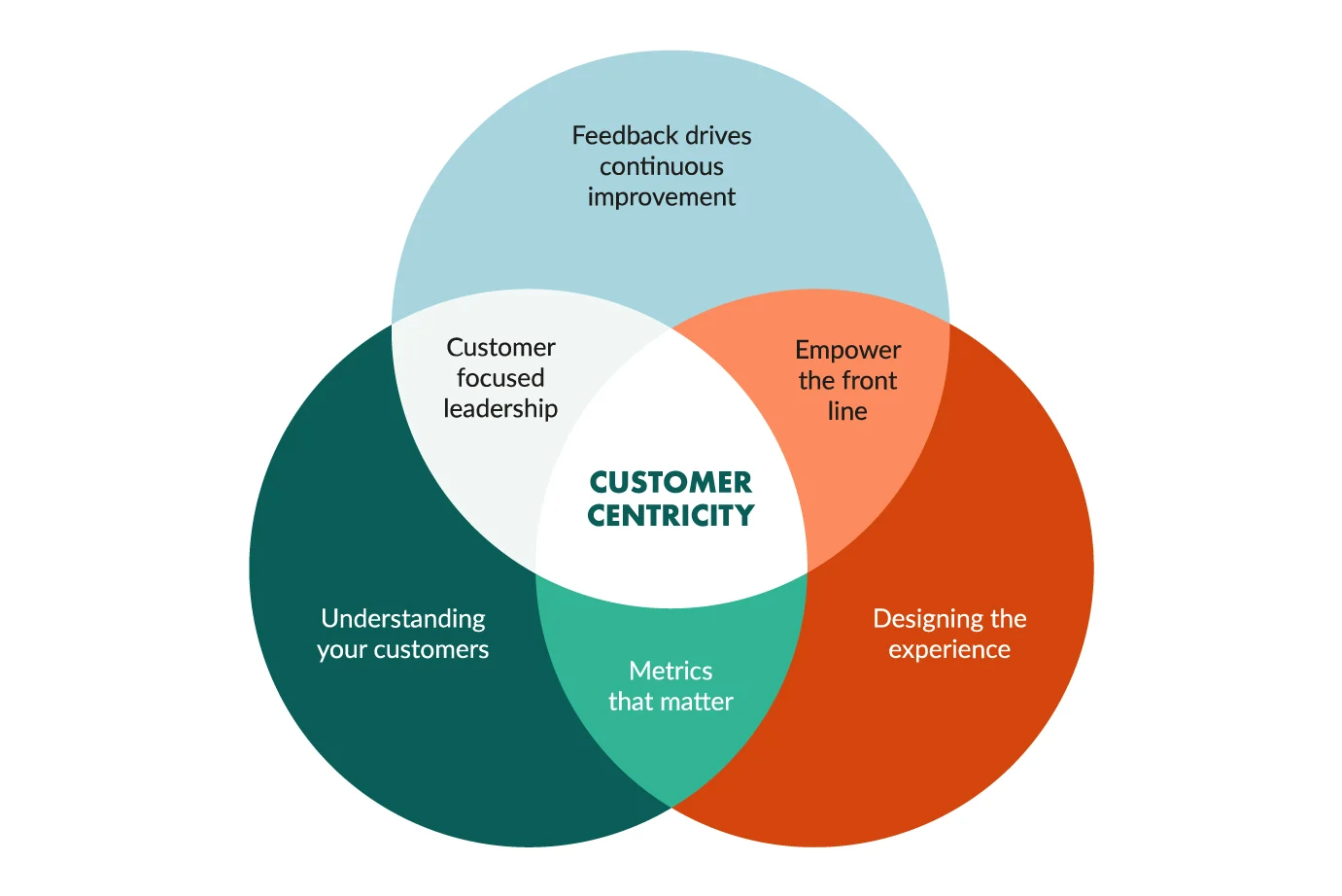

Member-Centric Philosophy:

At the core of Delta Community Credit Union’s philosophy is a deep commitment to its members. Unlike traditional banks, which prioritize profits and shareholders, Delta Community Credit Union operates as a not-for-profit cooperative, meaning that its primary focus is on serving the best interests of its members. This member-centric approach is evident in every aspect of the credit union’s operations, from its competitive rates and low fees to its personalized service and community engagement initiatives.

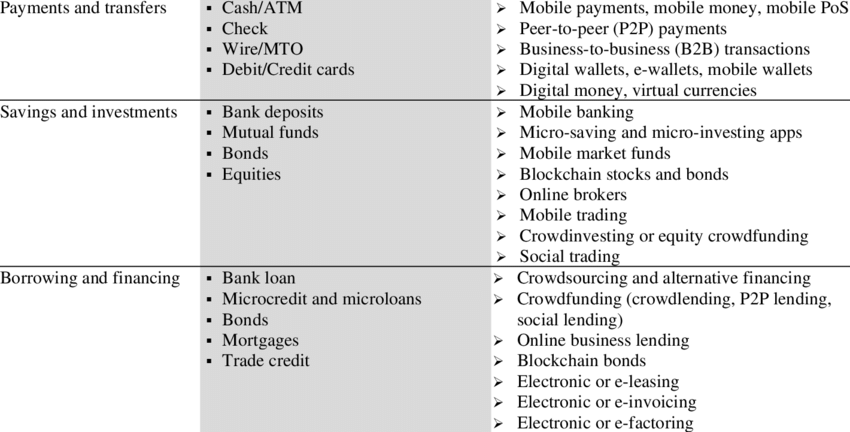

Financial Products and Services:

Delta Community Credit Union offers a comprehensive suite of financial products and services designed to meet the diverse needs of its members. From checking and savings accounts to mortgages, auto loans, and investment services, the credit union provides a full range of banking solutions tailored to help members achieve their financial goals. What sets Delta Community Credit Union apart is its commitment to transparency, integrity, and financial wellness, ensuring that members have access to the tools and resources they need to make informed decisions about their money.

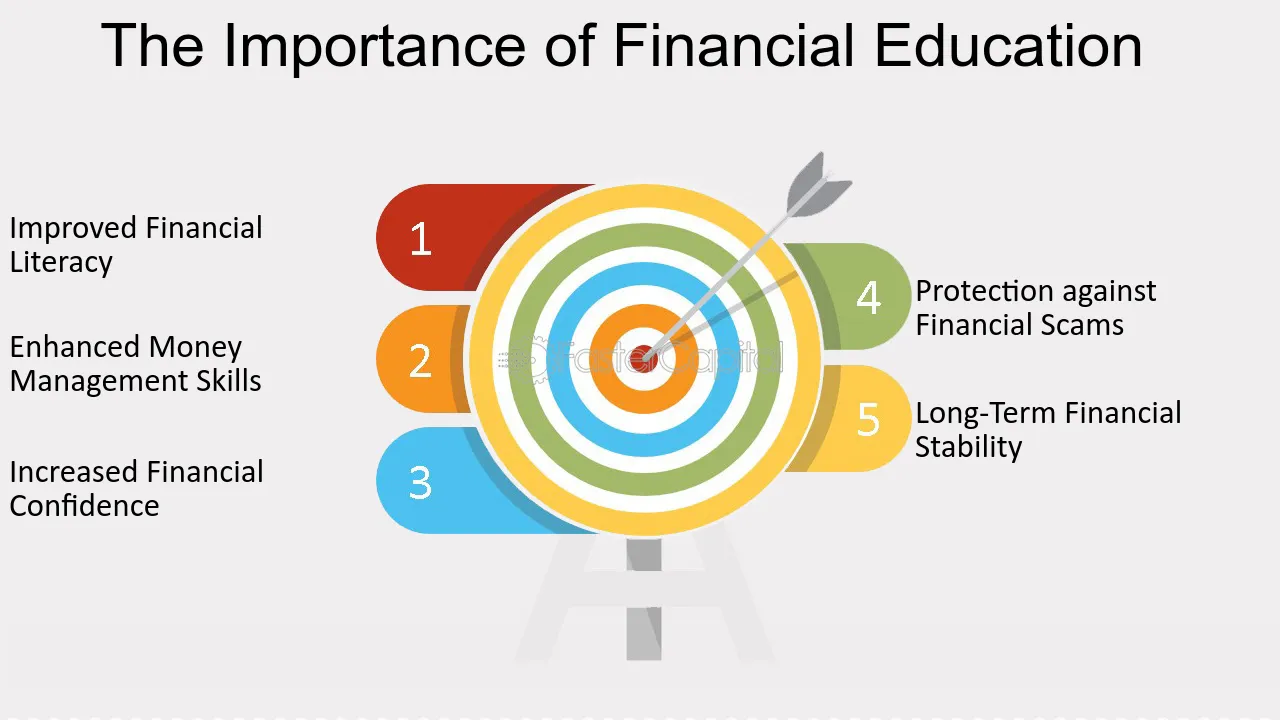

Empowering Financial Education:

Financial literacy is a cornerstone of Delta Community Credit Union’s mission. The credit union believes that empowered members are better equipped to make smart financial decisions, plan for the future, and achieve their dreams. To that end, Delta Community Credit Union offers a variety of educational resources, workshops, and seminars aimed at improving financial literacy and promoting financial empowerment among its members.

Community Impact and Engagement:

Delta Community Credit Union is deeply committed to making a positive impact in the communities it serves. Through its Community Development initiatives, the credit union partners with local organizations, nonprofits, and community leaders to address critical needs, support economic development, and promote social equity and inclusion. Whether it’s through volunteerism, charitable giving, or community partnerships, Delta Community Credit Union is dedicated to being a force for good and helping build stronger, more resilient communities.

Conclusion:

In conclusion, Delta Community Credit Union is more than just a financial institution; it’s a catalyst for positive change and community empowerment. With its member-centric philosophy, commitment to financial education, and unwavering support for its communities, Delta Community Credit Union exemplifies the values of cooperation, mutual support, and shared prosperity. As it continues to evolve and grow, Delta Community Credit Union remains steadfast in its mission to nurture financial prosperity and well-being for its members and the communities it serves.

For More Information Please Visit These Websites Viprow And Redgif