Table of Contents

Introduction

In the realm of cryptocurrency and decentralised finance (DeFi), token farms have emerged as a prominent mechanism for earning passive income and participating in governance within blockchain ecosystems. Token farms, also known as yield farms or liquidity farms, allow users to stake their assets in exchange for rewards in the form of additional tokens. While token farms present exciting opportunities for investors and enthusiasts, they also come with inherent risks and complexities. This article aims to provide a comprehensive overview of token farms, exploring their mechanics, benefits, risks, and the evolving landscape of decentralised finance.

Understanding Token Farms: Mechanics and Operation

Token farms operate on the principles of liquidity provision and yield generation within decentralised platforms such as decentralised exchanges (DEXs) and automated market makers (AMMs). Users provide liquidity by depositing their cryptocurrency assets into liquidity pools, which are then utilised for trading and other DeFi activities. In return for their contribution, users receive rewards in the form of additional tokens, often proportional to their share of the total liquidity pool.

Benefits of Participating in Token Farms

Participating in token farms offers several potential benefits for investors and participants. Firstly, token farms provide an avenue for earning passive income through yield generation. By staking assets in liquidity pools, users can earn rewards in the form of newly minted tokens or transaction fees generated by the platform’s trading activities. Additionally, token farms often offer opportunities for governance participation, allowing users to vote on proposals and decisions related to the platform’s development and management.

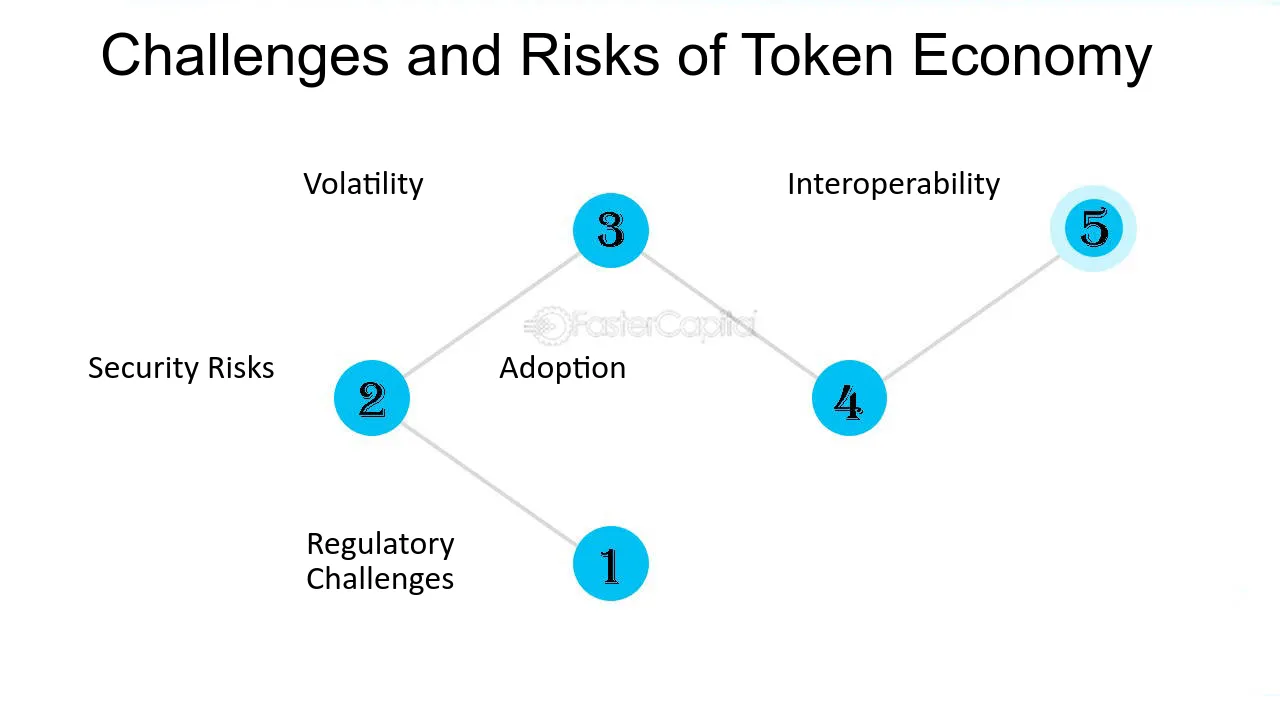

Risks and Challenges Associated with Token Farms

While token farms present lucrative opportunities for yield generation, they also entail certain risks and challenges that investors should be aware of. One primary risk is impermanent loss, which occurs when the value of the deposited assets fluctuates relative to each other. This can result in a reduction in the overall value of the liquidity provided, offsetting potential gains from yield farming rewards. Furthermore, token farms are susceptible to smart contract vulnerabilities, hacking attacks, and market volatility, which can lead to loss of funds for participants.

Navigating the Evolving Landscape of DeFi

The decentralised finance space is rapidly evolving, with new protocols, platforms, and innovations continually emerging. As such, participants in token farms must stay informed and adapt to changes in the DeFi landscape. This includes conducting thorough research on projects and protocols before participating in token farms, as well as staying vigilant for potential risks and vulnerabilities. Additionally, participants should diversify their investment strategies and avoid overexposure to any single platform or asset.

Regulatory Considerations and Compliance

As the DeFi ecosystem continues to grow and attract mainstream attention, regulatory scrutiny surrounding token farms and decentralised finance is also increasing. While DeFi platforms operate in a decentralised and permissionless manner, regulatory authorities in various jurisdictions may seek to impose regulations or oversight to address concerns such as investor protection, financial stability, and anti-money laundering (AML) compliance. Participants in token farms should be mindful of regulatory developments and ensure compliance with relevant laws and regulations.

Conclusion

In conclusion, token farms represent a dynamic and innovative aspect of the decentralised finance landscape, offering opportunities for passive income generation, governance participation, and engagement within blockchain ecosystems. However, participants must approach token farms with caution, recognizing the inherent risks and complexities involved. By understanding the mechanics, benefits, and risks of token farms, investors can make informed decisions and navigate the evolving landscape of decentralised finance with confidence. As the DeFi ecosystem continues to evolve and mature, token farms will likely play an increasingly significant role in shaping the future of finance and blockchain technology.

For More Information Please Visit These Websites Viprow And Vecteezy

No Comments

Terrific work! This is the type of info that should be shared around the net. Shame on the search engines for not positioning this post higher! Come on over and visit my web site . Thanks =)